The recent shake-up in the crypto market has turned many heads and prompted a “crypto meltdown,” which has been considered by many as long overdue. Thanks to social media, the crypto craze and the term “HODL” have recently become synonymous. Although crypto is still hotly debated, the strategy behind “HODL” (Hold On for Dear Life) is not a new concept– at least not to anyone familiar with the financial market.

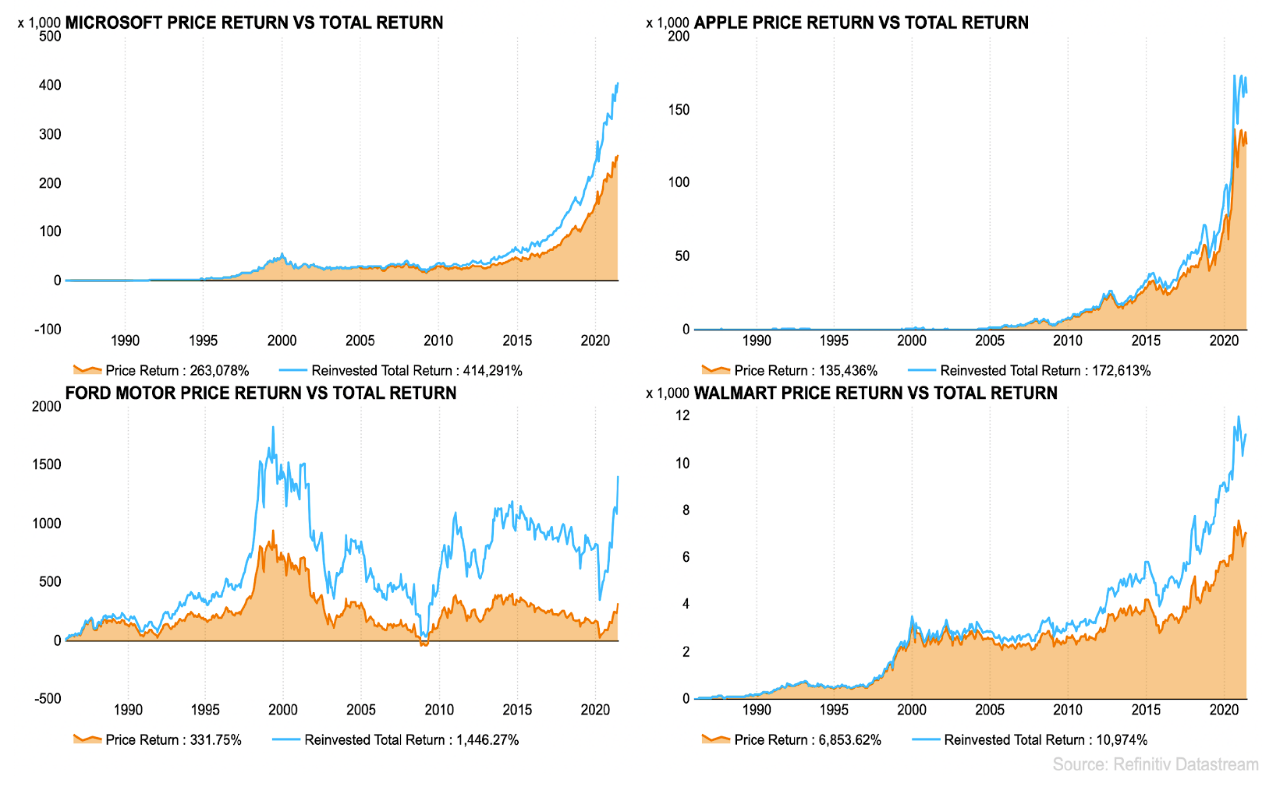

Holding a fundamentally solid company and generating cash flow for the long term has been a recommended risk-averse approach for many decades, considered to be one of the safest strategies for investors. A Look back in history can reveal some valuable lessons – consider two of the most valuable companies on the market today, Apple (AAPL) and Microsoft (MSFT), the latter being the newest member of the 2 trillion club.

What Does That Mean?

Let’s assume that on 01/01/1986, investor John invested $1,000 in Apple (AAPL), allowed it to grow and enabled all dividends to be automatically reinvested. He did not pay much attention to the loud voices about impending financial collapse, or big red headlines. The result would be that his $1,000 would have become $1,768,360 as of 06/01/2021.

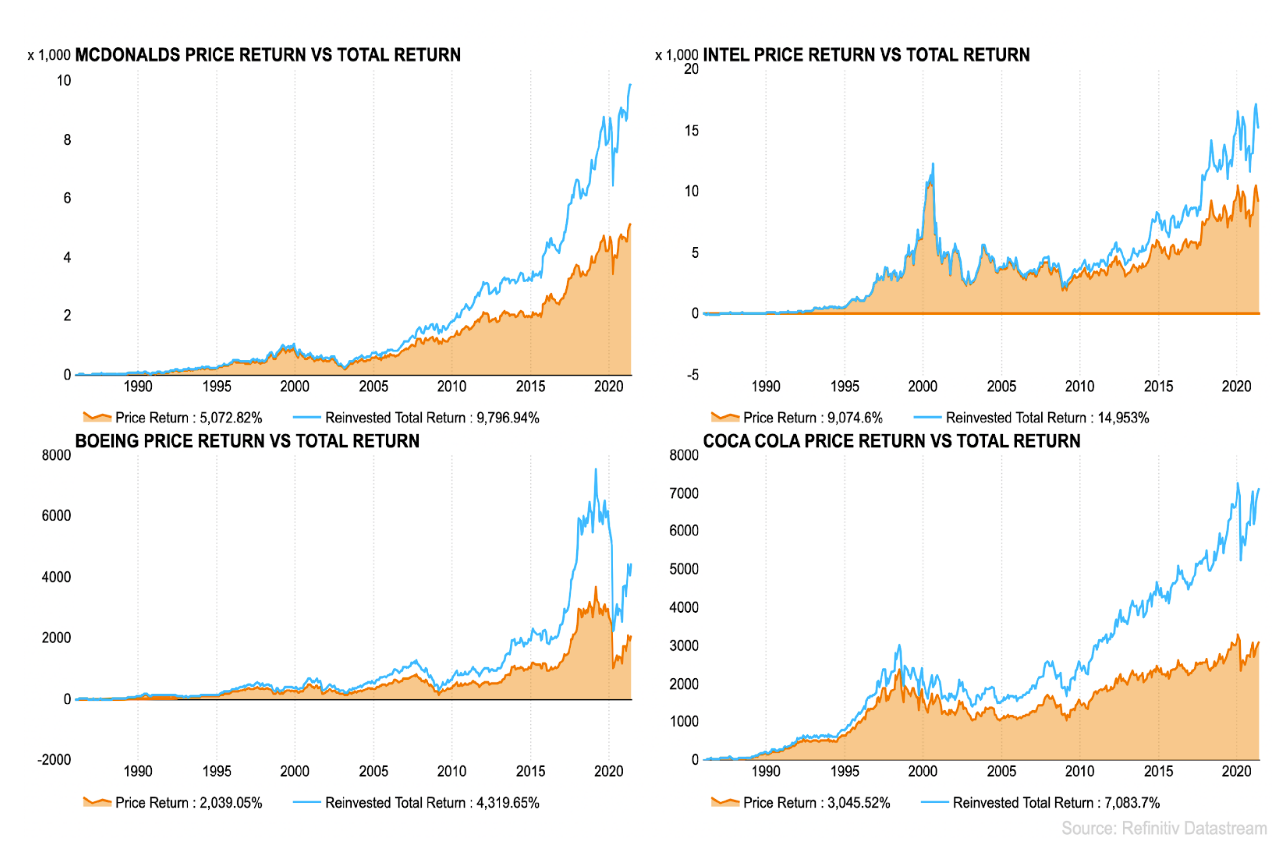

Alternately, if Apple (AAPL) seemed too risky to invest in back in 1986, and McDonald’s (MCD) was John’s choice, he would’ve ended up with a considerable total return of 7083% as of 06/01/2021. The same can be said for other companies such as Coca Cola (KO), Boeing (BA), INTEL (INTC), Walmart (WMT), or even Ford motors (F) with its comparably humble returns.

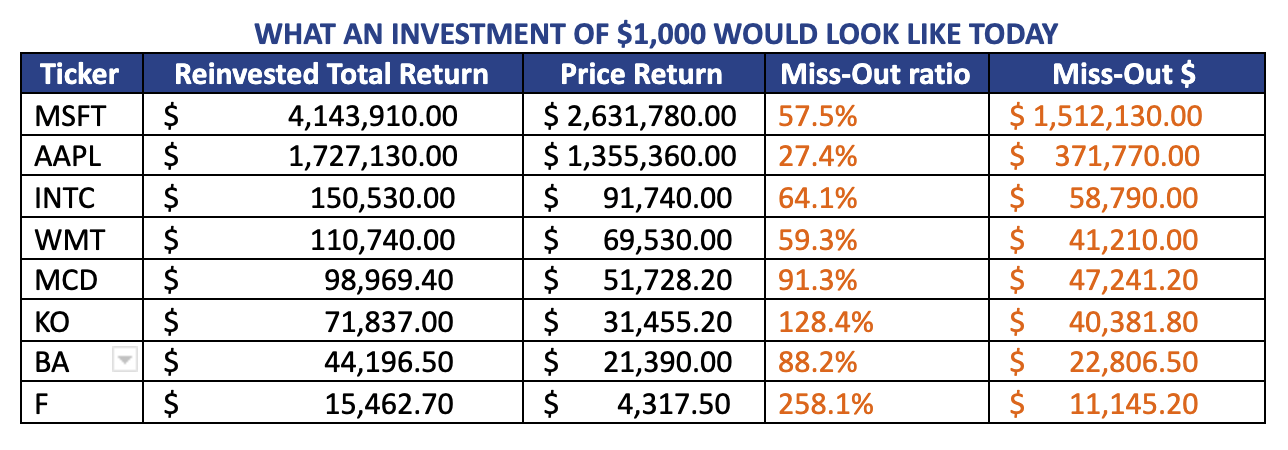

The Strategy and Miss-Out Ratio

As simple as it sounds, to apply “HODL” is easier said than done, let alone hold on for dear life AND reinvest all dividends, especially when everyone is panicking. The table below provides a compelling argument for reinvesting dividends. We even took it a step further to measure uptrend loss for not reinvesting dividends and compared both scenarios’ current market value.

Conclusion

In a fast-paced market, it is easy to succumb to green flashing banners with one-month double-digit return figures. While high returns are sought after, they are the tip of the iceberg behind fundamentally solid processes geared towards achieving financial success. Like any good plan, they need time to solidify, run their course, and reach milestones before arriving to their final goal. After all, investing is not a sprint, but a marathon.

Disclaimer: These values are calculated using historical opening price on 01/01/1986 or the oldest available and considering all splits and dividends history. Therefore, the results presented here are not 100% accurate and just a close estimation.

This is not a recommendation to purchase or sell the stocks of the companies pictured/mentioned. Holding investments for the long term does not insure a profitable outcome. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Keep in mind that there is no assurance that any strategy will ultimately be successful or profitable nor protect against a loss.