The past decade was unique in a way that will be remembered for many decades to come. The prolonged Quantitative easing “happy times”, when central banks in most developed economies (with few exceptions), provided cheap access to cash with the aim of stimulating economic growth, and more growth, until a global pandemic occurred, which disrupted an already strained supply chain and left economies with so much cash, but not so much to buy. Even more, as the globe was recovering, the biggest conventional war since the 2nd world war erupted in Ukraine, sending shock waves across Europe and the world, renewing fears of prolonged inflation. Simultaneously, central banks scrambled to apply various measures, hoping to avoid what’s become known as “hard landing” (defined as negative economic output in the form of negative GDP growth) with minimum damage to the financial market.

Although many argue that the stock market is an indication of the health of an economy, others argue that the former is a result of the latter; however, it’s commonly understood that the stock market is inherently risky in its nature, primarily due to the inability to predict price fluctuation caused by countless factors. As worrisome as the above sounds, risk is embedded in the equity market

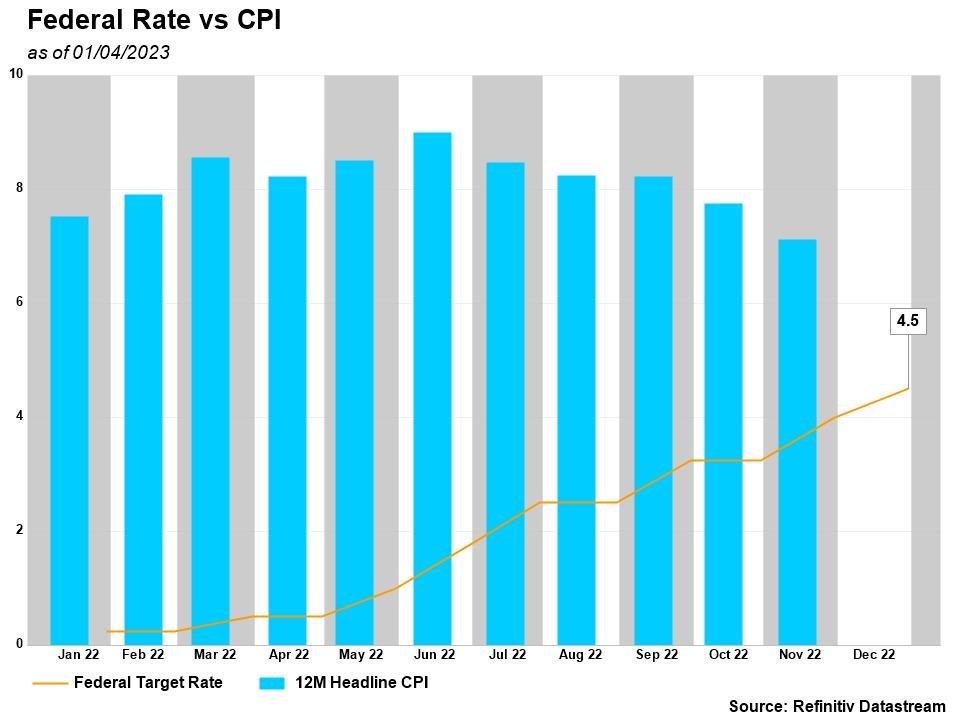

Returning to the topic of central banks policies, the low interest rate environment combined with low inflation in the last decade offered additional incentive to invest in the risky stock market, where up until 2019, the mean annual return was around 7%. In 2022 however, the US central bank, aka the Federal Reserve, implemented a much needed series of rate hikes, marking an end to the low interest rate era. Although such a measure is straight out of the old economic handbook in an inflation rising environment, the pace was unprecedented, within 11 months, Federal target rate jumped from 25 basis points in February to 450 in December, Nevertheless, in such unique times, opportunity can be found in the not-so-unexpected places.

These rapid hikes within a brief 10 month-window aimed to destroy demand; and destroy it did. As a side effect, existing bonds have become heavily discounted, to a point that finding a 10Yr 2% coupon investment grade bond with yield to maturity (YTM) of 4.0% became the new norm. This quick change in Fed target rate will lead new bond issuers to stick a higher coupon tag on their new issues, so as to look attractive for bond investors. To put this into perspective, in order for new debt to be appealing, it must offer higher return than Risk Free US treasuries; therefore, tracking US treasuries yield can help potential investors. For example, when a newly issued 5-year US T-Note has a 4.5 YTM, it would not be wise to invest in a 5-year AA corporate bond with YTM less than 4.5. This begs the question, if the fixed market is looking attractive now, what are the risks involved?

First, In a rising inflation environment, Fixed income is the least attractive asset class; the reason lies in none other than its name, Fixed Income. To elaborate, the rate of return is fixed for existing investors and inflation risk is highest; alas, if inflation remains stubborn or continues to rise, bond coupons will be irrelevant, as inflation will increasingly chip away from it. That said, assuming inflation won’t be elevated for more than 1-2 years, its effect on long term bonds would be at minimum, unlike shorter maturity ones. Second, the lower the credit rating, the higher the default risk; to compensate potential investors for the higher risk, issuers stick a higher coupon tag on lower rated bonds.

To summarize, this year might present a unique opportunity for fixed income; though this assumption rests on two pillars: First, inflation continuing to ease down. Second, dovish Fed tune backed by a cease of further hikes for the year.

720 Rugby St Ste 200

Orlando, FL 32804

407.648.1881

Securities offered through Raymond James Financial Services, Inc., member FINRA/SIPC. Investment advisory services are offered through Raymond James Financial Services Advisors, Inc. Edgewater Family Wealth is not a registered broker/dealer and is independent of Raymond James Financial Services.

Opinions expressed in the attached article are those of the author and are not necessarily those of Raymond James. All opinions are as of this date and are subject to change without notice. Investing involves risk and you may incur a profit or loss regardless of strategy selected.